Graphite Miners News For The Month Of July 2019

Graphite Miners News For The Month Of July 2019

?China Graphite flake spot prices were lower in July.

?Graphite market news - An oversupply of flake graphite is hurting prices.

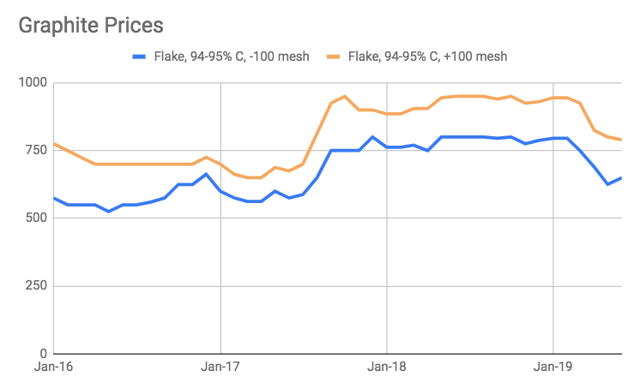

Graphite price news

During July China graphite flake-194 EXW spot prices were down 2.58% and are down 12.58% over the past year.

Graphite prices 2016 to ~May 2019

Source: Investing News courtesy of Benchmark Intelligence

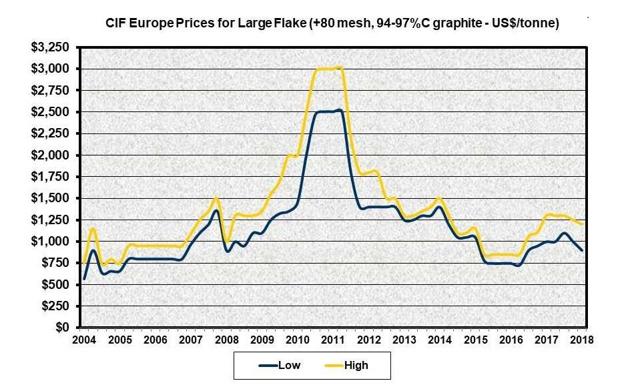

Graphite prices 2004 to end 2018

Source: Northern Graphite

Graphite market news

On July 6, Kitco Media reported (audio): "Battery materials will bounce back - Benchmark Minerals (Andrew Miller)."

On July 15, Fastmarkets reported:

Battery and Supply chain conf: Six things we learned in Qiandaohu. It is difficult to completely substitute spherical graphite due to its relative better lithium-storage capacity as a lithium-ion battery anode material, a China-based anode producer told Fastmarkets on the sidelines of the conference. This means graphite demand from the downstream battery sector and spot prices are like to remain stable. Spherical graphite is mostly used in carbon anodes despite the emergence of silicon-based anodes as a potential substitute. Demand for flake graphite from the anode sector has been supported by rising anode production capacity in China. Shanshan Technology, one large anode materials producer in China, is building the first phase of a lithium-ion anode line in Inner Mongolia with capacity to produce 40,000 tonnes per year of anode. The line will start operations in the third quarter of this year, Xie Qiusheng, senior engineer from the Shanghai Shanshan told delegates... Yet demand from the traditional downstream consumer - aluminum-magnesium-carbon (al-mg-c) brick used as a refractory material - is falling due to reduced output of al-mg-c brick in China following environmental scrutiny. This drop in demand has put flake graphite prices under downward pressure.

On July 16, Investing News reported:

Graphite Market Update: H1 2019 in Review... One of the main trends in the graphite sector during the first half of the year has been the continued growth of value-added applications, in particular from the battery sector, Benchmark Mineral Intelligence Head of Price Assessment Andrew Miller told the Investing News Network [INN]. "As with many battery raw materials, graphite finds itself in a transition period where new capacity has been installed but the real major changes in demand have not yet been felt," he said. However, he explained, there is still very good demand growth from the battery sector as well as from other value-added markets such as expandable graphite... However, looking specifically at 2019, the main news in the graphite space has been the introduction of new supply, with massive investment done in recent years on the synthetic side to establish graphitization and carbonization capacity to facilitate more output, according to Miller. Meanwhile, on the natural graphite side, major new volumes of feedstock have come from Africa, in particular Syrah Resources [ASX:SYR, OTC Pink:SYAAF]... According to the expert, prices for feedstock have certainly come down as the new supply hit the market, but not as much as some have indicated. "The major decreases some have reported are largely for fines or fake flake material which has become increasingly prominent with increased supplies," he said. Benchmark Mineral Intelligence expects prices to continue to decline into H2 as excess supplies remain in the market.